Taking thoroughly into account all the remarkable changes and trends in the global financial market, my institute, IISIA, tries to update its future scenario everyday. At this juncture, there are three elements of significance in this regard: USD, gold (AU) and Xi Jinping’s state visit to Japan.

USD and gold (AU) are soaring while other currencies and financial products are depreciated heavily. Major mass media such as Nikkei Shimbun (Japan) argues that investors are seeking to put their money into “safe haven”, as which USD and gold (AU) are always regarded. From my viewpoint, however, this is a typical non-substantial statement mass media often release to the public. There are obviously other important reasons for the dramatic “sea change” in the financial market.

Let’s take the example of “USD” at first: US has only two “alliance partners” in the world, on which the country’s fate actually relies. That’s Israel and Japan. With the former, US can put all its military high-technology to real battlefields (mainly in Middle East), where they can check the technology’s effectiveness. Thus, US-Israel alliance is characterized rather as military one. As for Japan, US has been establishing another “financial” type of alliance since the end of WWII, even though the ordinary Japanese people think it to be military security alliance.

Just before a financial crisis, US used to massively transfer its money via FRB and Bank of Japan to special account in one of the designated megabanks in Japan. For example, just before the Christmas in 2007, US transferred 70 trillion USD to the Japanese special account. The reason why was quite simple. Since the US leadership “behind the door” were fully aware of the forthcoming financial disaster from autumn of 2008 in advance, it just took a preemptive measure by using the “special account “ in Tokyo, as it had repeatedly done beforehand since the end of WWII. After saving the money on this way, the US-American leadership “behind the door” got it back safely and uses it afterwards. This is the real story of US-Japan alliance.

As it might have occurred to you while reading the above-shown explanation, massive transfer of USD thorough central banks’ channel affects exchange rate between USD and Japan almost simultaneously. If US transfers it to Japan “behind the door”, JPY is extremely appreciated as we’ve seen after 2008. It’s the case vice versa, therefore, the current abrupt appreciation of USD against JPY shall be understood in this context. This is, from my understanding, obviously a typical EWS (=early warning signal) given in advance that something significant will take place in Japan in the very near future. And compared with such a drastic development in Japan, US will be treated as “safe haven”, at least , for a while.

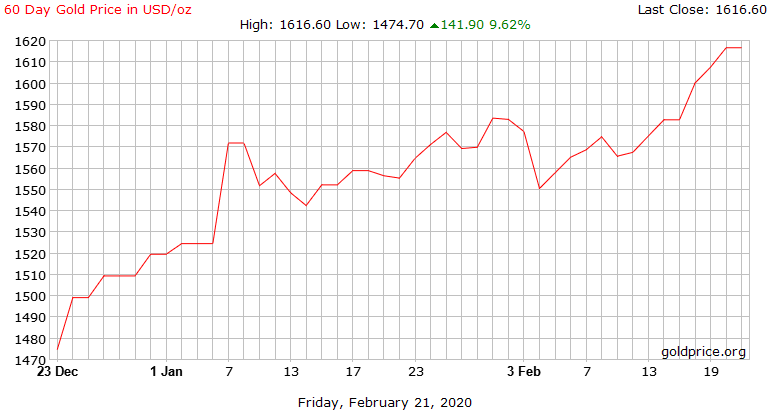

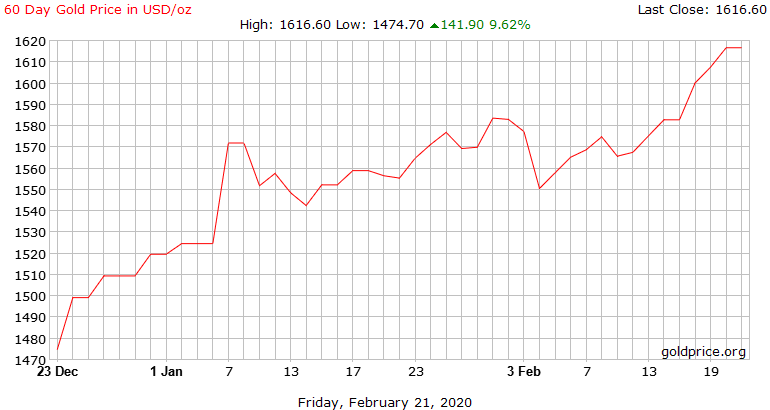

Move to the second example “gold (AU)”: All the major central banks made and revised (*Please carefully check the below) their “cartel” in gold (AU) market called“Washington Agreement on Gold”, which expressively limits sales volume of gold reserve by attending central banks. Nevertheless, to be honest, it’s just a diversion, and central bankers have their secret “way out” to sell their gold reserves indirectly to the market. The name is “BIS gold swap”, which is even officially reported from the secretariat of “the central bank of central bankers”. In this scheme, central bankers are entitled to borrow money from BIS, while being obliged to collateralize on their gold reserves. Intentionally, central bankers never keep their written promise to give back the money after due date of payment, and BIS is both legally and automatically entitled to purchase the gold (AU) given by central bankers (borrowers) as collateral.

Historically viewing, whenever BIS gold swap has been done, the gold (AU) market tended to go up in advance. You know why? Here you’re with the golden principle for AU seller, “Higher price, better sale”. Gold (AU) market is obviously manipulated in accordance with central bankers’ request, who have to collect cash as much as possible before shock waves, or even unprecedented negative changes in the global financial market. Now that gold (AU) price is being enough appreciated right now, we may expect something significant to happen in the very near future as well.

And don’t forget the fact central bankers did neither extend the previous agreement from 2014 nor make a new one, at least so far. This means they can well their gold reserves as much as they wish. Can you see their real intention?

Last but not the least, Xi Jinping’s visit to Japan. As far as I know, the CCP leadership will discuss on 24 February whether the President should go to Japan as state guest to be welcomed by His Majesty Emperor of Japan. My institute is well informed through confidential channels of the realities in terms of COVID-19 in mainland of China. However “bad” the realities are in this regard, a green light for this state visit obviously gives various important implications and effects to PRC and other parts of the global community. Once the green light will be shown, the CCP leadership will try to make most efforts regardless of disastrous realities to pretend as if the situation would become better and better. Major investors will take advantage of this “man-made” change of trends to make the market go up or even “rocket” at least in short term. They know the situation will become much worse afterwards, and try to make profit in advance as much as they can. That’s it.

In short, “There is no way to go, but we shall go forward”. And that’s exactly why our institute has been enthusiastically appeals to the global community for the significance of “information literary”, a human skill to make our own future scenarios based on various information and data freely acquired in the internet. Do you eventually understand how significant my institute’s mission is for the entire human beings?