The Age of Stress Management

The global financial market continues to collapse. Some “experts” refer even to comeback of financial meltdown we faced in the autumn of 2008. A nightmare.

However, I myself do not advocate such a dramatized propaganda. Because it’s extremely obvious what central bankers envisage. To make “negative” real interest rate happen is their ultimate goal. You can realize it immediately, when you take a look at the following three-steps scenario:

-Step 1

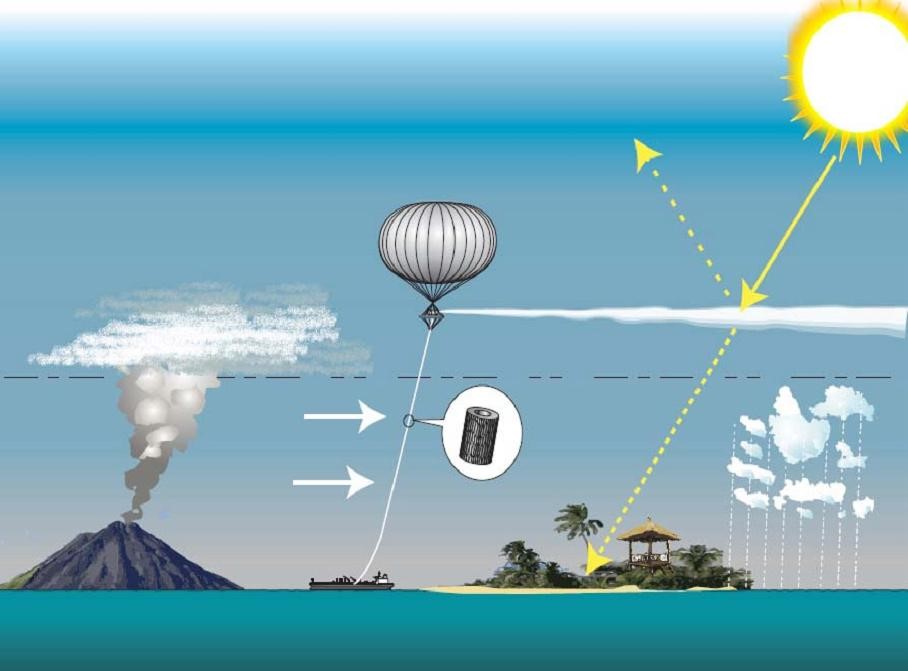

In a coordinated manner, central bankers of major countries such as US, EU, Japan and even PRC take steps for quantitative easing. A huge amount of money is scattered in the market.

-Step 2 (We are here!!)

Central bankers introduce “negative nominal interest rate” in their own financial policy. They never explain the people on the street what they really want to do with that, since the people are supposed to not be capable of realizing complicated matters like this scenario (sic!).

-Step 3

By asking other powers, central bankers enable typical commodities such as crude oil, gold and copper to soar in the financial market. The reasoning as such doesn’t matter. For this purpose, you can use, for example, “war economy” or “a coordinated cut in oil production”. Once inflation begins, it automatically becomes obvious that negative real interest rate emerges. As you know, it is “nominal interest rate” minus “inflation rate”.

As long as you face the period of negative “real” interest rate, you can theoretically enjoy de facto economic stimulus. That’s exactly what central bankers actually focus on.

Welcome to the one-way to default of nation’s economy! Because central bankers have to raise nominal interest rate in proportion to inflation rate, they will, sooner or later, reach the limit of this smart policy. It’s limited because of payment of national debt. In such a highly indebted country as Japan, you can easily reach the limit. If the government will fail to boost its economy appropriately regardless of “negative real interest rate”, it can’t simply help declaring its own default.

The point is the default of national economy as such is pretty good for the government, because it means the government will finally get rid of debt burden. Nevertheless, you may not disregard from where a reverse fund to cover such a huge loss comes.

Once the above mentioned “negative real interest rate” will be realized, you can enjoy a kind of asset bubble just for a while. Yes, “just for a while”. After that, volatilities in the market will be both sharpened and accelerated, and what you really need is your own stress management.

The age of stress management is about to begin. Those who are aware of this simple fact in the very near future will be able to survive in the world. Watch out.