The Age of Commodities and China as a Black Swan.

After FOMC’s decision to raise the US interest rate, BOJ announced to step forward in terms of its historical quantitative easing. However, expectation of investors gradually turned out to be total disappointment, while they understood BOJ will just start to sell off shares which it acquired as a measure of the QE from Japanese banks. The stock market rather collapsed since then.

Based on the facts we’re now facing, I can’t help getting back to the most significant rule in the universe: Le Chatelier’s Principle. Whatever soars, will fall in the next phase, and vice versa. So far, stock markets all over the world have been rocketing. Therefore, it’s quite natural they’ve just begun to collapse.

Almost all the so-called “analysts” in the financial market are trying to seek the root for the current situation in commodities: Because of falling commodity prices, stock prices are also involved in downturn. Particularly, disastrous trend of crude oil has been accelerating the trend, they are used to explain.

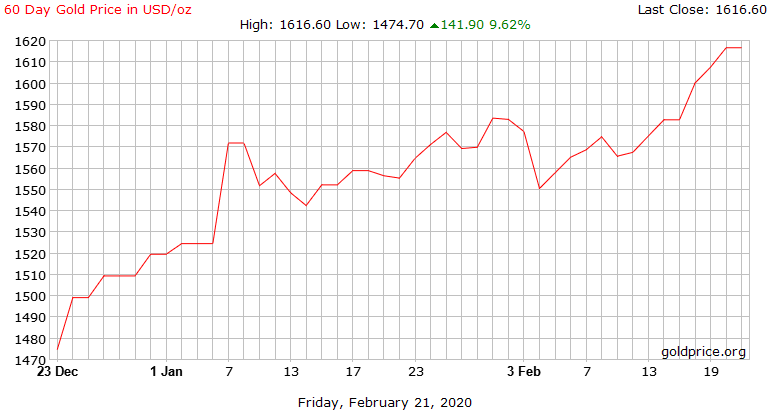

I strongly doubt the authenticity of such an explanation, since I’m fully aware thanks to daily quantitative analysis by my closest alliance partner, Mr. HKD, of the fact institutional investors now begin to bet money for higher oil, gold and (even) copper prices in the very near future. Oh, yes, “copper”. Can you finally understand what I mean by mentioning it??

The guys of Goldman Sachs refer to their analysis on the future trend in the oil market. According to their prognosis, the crude oil price will keep its downturn because of the following three factors: Warm winter, hard times of emerging markets and the end of Iranian economic sanctions. Now, you have to wonder what would happen, if the opposite cases of all these three would come true?

In this regard, I personally concentrate on the Chinese mainland economy. The shock wave caused by the Chinese market in the last summer seems to be rather artificial. PRC is about to lead the world economy by its chairmanship of G20 in 2016. To make it extremely successful, the Chinese leadership must have decided to make use of the above shown “Le Chaterlier’s principle”. To go up, the leadership made its economy go down once.

When the Chinese mainland economy will start to revive, everything in the market will be changed dramatically. This will be the case especially for commodity prices. The current quantitative analysis on copper price indicates such a dramatic change in the very near future. This brand new trend will stimulate and inflate the global economy, and higher inflation rates will lead us to face “minus” real interest rates in spite of higher nominal interest rates. This is exactly why FOMC has just made its mind to raise the (nominal) interest rates up to 0.5%. Behind the door, there must be a secret deal between US-American and Chinese bankers.

Be prepared for the coming age of commodities. Only more or less than one month is left for you to load a new gun. Stay tuned.